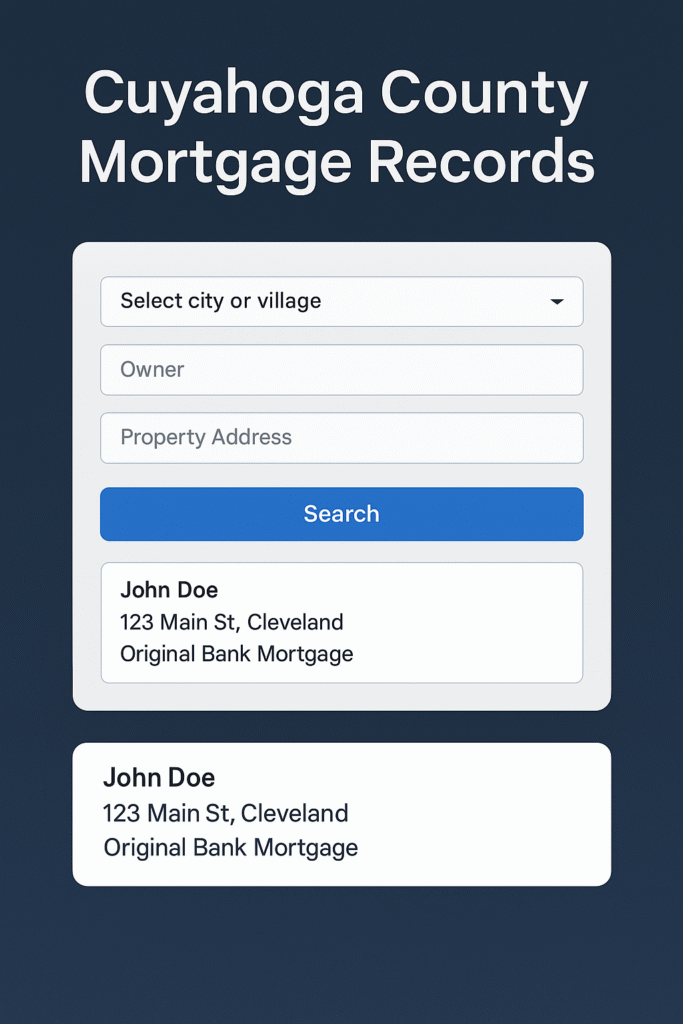

Instantly search Cuyahoga County mortgage records by city, owner name, or property address. Access verified property and ownership details for all cities and villages in Cuyahoga County, Ohio

Search Cuyahoga County Mortgage Records by Owner Name & Property Address

🏠 Cuyahoga County Mortgage Record Lookup

How to Use the Cuyahoga County Mortgage Lookup Tool – Step-by-Step Guide

The Cuyahoga County Mortgage Lookup Tool is designed to help residents, real estate professionals, and researchers easily access official mortgage and property ownership records. This tool offers a convenient way to search property information across all cities and villages in Cuyahoga County, Ohio, using a clean and intuitive interface. Below is a step-by-step guide on how to use the tool effectively.

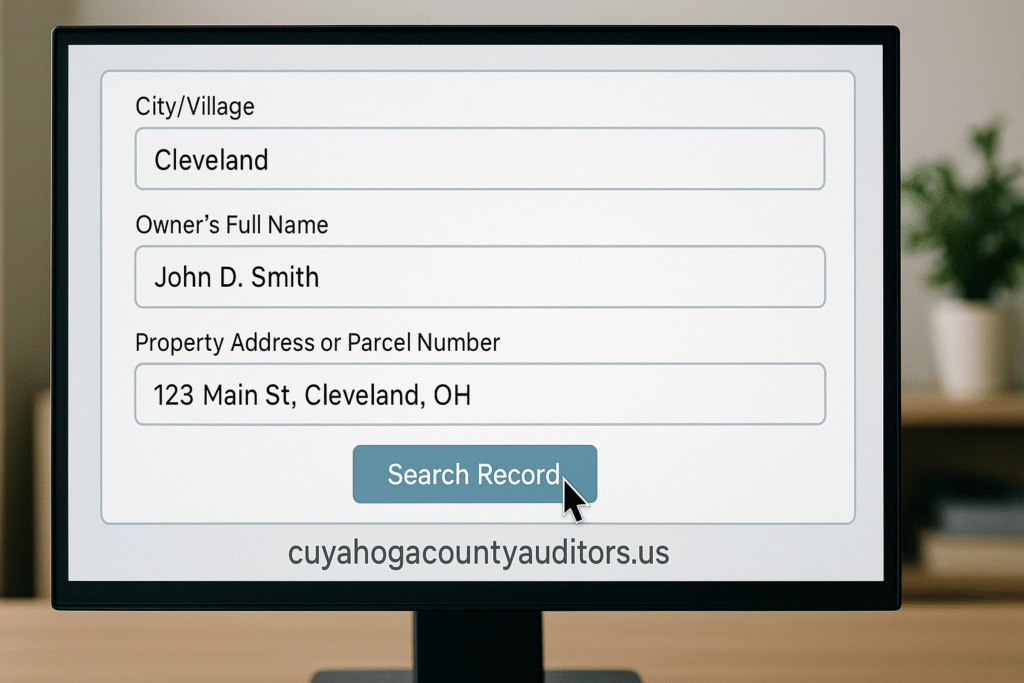

Step 1: Select a City or Village from the Dropdown List

Start by selecting the city or village where the property is located. The dropdown menu includes all municipalities in Cuyahoga County, ensuring complete coverage. Whether the property is located in Cleveland, Lakewood, Parma, Beachwood, or any other jurisdiction within the county, you will find it listed. This step helps filter the records based on geographic location for more accurate search results.

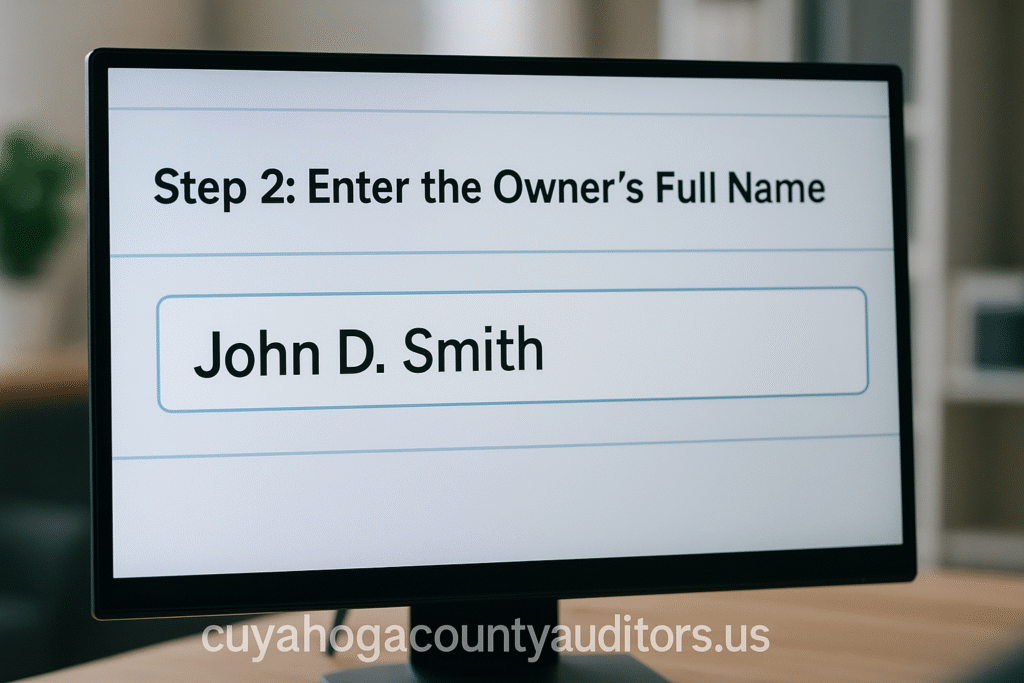

Step 2: Enter the Owner’s Full Name

In the second step, you are required to enter the full name of the property owner as registered with the Cuyahoga County Fiscal Office. This field helps narrow down the search results to only those properties associated with the specified owner. Accurate and complete name entries lead to more precise results, so it is recommended to use the official spelling and formatting as it appears on public records.

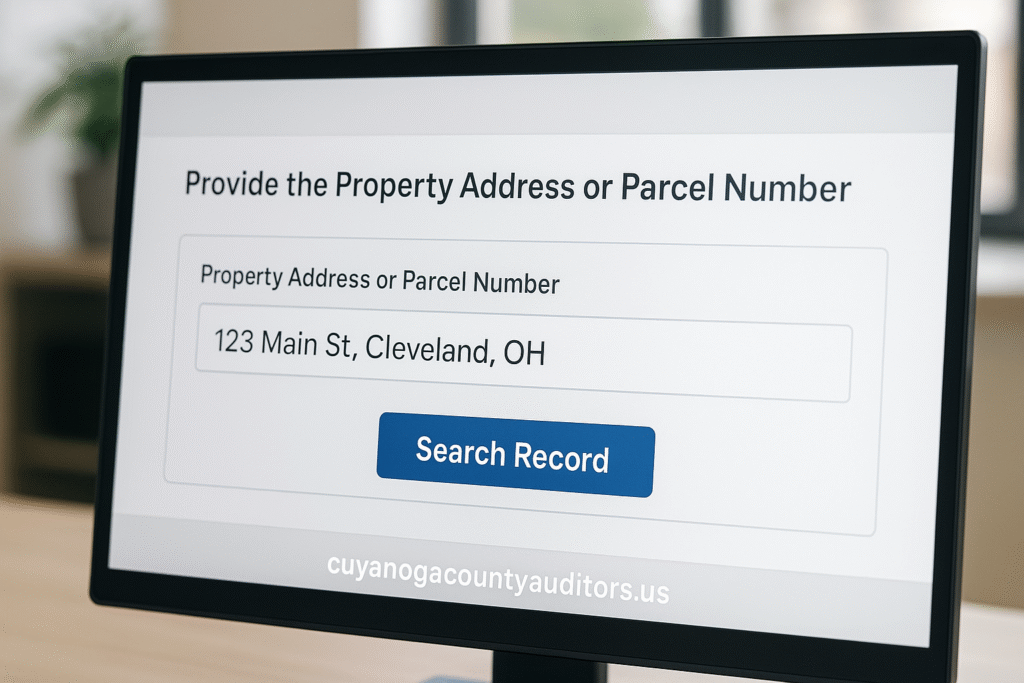

Step 3: Provide the Property Address or Parcel Number

Next, enter the property’s address or parcel number. This information helps the system locate the exact property you are looking for. Even partial addresses may work, but for best results, include the complete address or the official parcel identification number if available. This ensures the search is specific and reduces the chance of multiple similar results appearing.

Step 4: Submit the Search Form

Once all fields are filled in correctly, click the “Search Record” button to submit your request. The tool will process the information you’ve provided and generate a search result based on official public records. The process is fast and secure, ensuring that users receive reliable and up-to-date property information.

Step 5: Review the Search Results

After submitting the form, a results section will appear on the screen displaying the key details you searched for. These include the selected city or village, the property owner’s name, the address or parcel number, and a direct link to view the official mortgage documents on the Cuyahoga County Fiscal Office website. This link provides full access to ownership history, deed records, mortgage filings, and other legal documentation related to the property.

Why Use This Tool?

This mortgage lookup tool is built to provide a quick, accurate, and user-friendly way to retrieve essential property records. It saves time by eliminating the need to manually navigate through county websites. The tool is especially useful for home buyers, real estate agents, legal professionals, tax consultants, and anyone involved in property transactions or verification. Most importantly, it is based on official public data sources, ensuring authenticity and legal reliability.

Supported Locations

The tool supports searches in every city, village, and township within Cuyahoga County, Ohio, without exception. This includes, but is not limited to, Cleveland, Parma, Lakewood, Euclid, Strongsville, Shaker Heights, Garfield Heights, Bedford, and more than 50 additional communities.

1. An In-Depth Overview of Cuyahoga County Mortgage Records: What You Need to Know

Cuyahoga County mortgage records are official public documents that provide critical information about property ownership, liens, mortgages, and tax assessments in the county. These records are essential for homeowners, buyers, real estate professionals, and investors who need a reliable source to verify property history and ownership details. They are maintained by the Cuyahoga County Fiscal Office and can be accessed both online and in person, making them an invaluable tool for anyone involved in property transactions.

Understanding the contents of these records is vital for making informed decisions, whether you’re purchasing a property, assessing your investment portfolio, or seeking information about property tax liabilities. Cuyahoga County’s mortgage records include information on the amount of mortgage, the lender’s name, property description, and more, all of which help paint a clear picture of the property’s legal and financial standing.

2. How to Effortlessly Access Cuyahoga County Mortgage Records Online: A Comprehensive Guide

Accessing Cuyahoga County mortgage records online is a simple and straightforward process that can be completed from the comfort of your home. To begin, you need to visit the Cuyahoga County Fiscal Office’s official website, which hosts a comprehensive database of mortgage records available to the public. The website allows users to search for mortgage information using several criteria, including owner name, property address, and parcel number.

Once on the website, enter the required information into the search fields. You can search by specific criteria to refine the results. The tool also allows for keyword searches and provides links to view additional documentation, such as deed information, mortgage history, and tax assessments. This online access saves time compared to traditional in-person searches and ensures that you’re receiving the most up-to-date and reliable information directly from the county’s official database.

3. Mastering the Art of Mortgage Record Search in Cuyahoga County: Step-by-Step Instructions

Finding accurate mortgage records in Cuyahoga County requires following a methodical process that ensures you obtain the most relevant information. Here’s a step-by-step guide to help you navigate the search process:

- Visit the Official Cuyahoga County Fiscal Office Website: Start by navigating to the website dedicated to Cuyahoga County property records.

- Enter the Search Criteria: You can search for mortgage records by entering details such as the owner’s name, property address, or parcel number. Be as specific as possible to improve the accuracy of your results.

- Review Search Results: After submitting your search query, the results will display relevant mortgage records, including ownership details, the amount of the mortgage, the lender’s name, and property descriptions.

- Access Full Documentation: For a deeper dive, you can access full official documents related to the mortgage and property, including deed records and tax assessments.

- Cross-Check Information: To verify the accuracy of the data, consider cross-referencing with other official resources provided by the county.

By following these simple steps, you can efficiently retrieve accurate and detailed mortgage records for properties across Cuyahoga County, Ohio, ensuring your research is both thorough and reliable.

4. What Information is Contained in Cuyahoga County Mortgage Records? Unveiling the Details

Cuyahoga County mortgage records provide essential information about a property’s financial and ownership history. These records include details about the property itself, the amount of mortgage, the names of the involved parties (such as property owners and lenders), and legal documents related to the property. The records also contain information about any liens, unpaid taxes, or judgments placed against the property, which can impact a property’s market value.

For those involved in real estate transactions, these records are invaluable. They allow prospective buyers and investors to verify a property’s financial standing, ensuring there are no unexpected issues that could arise after a purchase. Additionally, mortgage records can provide insight into the payment history of the property, helping users assess whether there are any risks associated with taking over the mortgage or proceeding with a purchase.

5. The Complete Guide to Searching Mortgage Records by Owner Name or Property Address in Cuyahoga County

Searching for mortgage records in Cuyahoga County is a straightforward process, but the ability to narrow down results by specific criteria can help users obtain the exact information they need. Whether you’re searching by the property owner’s name or the address of the property, the steps remain simple yet effective.

To begin, users can search by entering the owner’s full name as it appears in the county’s property records. This helps filter results to show only those properties owned by that individual or entity. Alternatively, if you know the address of the property, entering it into the search field will return results that match the specific location.

For added convenience, the county’s online tool allows you to enter a parcel number—a unique identifier for each property in the county. Using this option will ensure that you’re accessing the most accurate records related to that specific parcel, as parcel numbers are directly linked to the property’s official records, including its mortgage history and any liens or claims associated with it.

6. Understanding How Cuyahoga County Mortgage Records Can Influence Your Property Decisions

Mortgage records in Cuyahoga County are more than just a way to access a property’s financial history—they are crucial tools for anyone making decisions about property investments, purchases, or sales. Whether you’re a homebuyer looking to confirm the financial status of a potential property, an investor assessing a property’s risk, or a real estate agent assisting clients with due diligence, mortgage records offer valuable insights into the property’s financial obligations.

By reviewing mortgage records, buyers can check whether the property has an outstanding mortgage or other financial encumbrances that could affect their purchasing decisions. Investors can use these records to determine whether a property has a clean financial history or if there are risks such as unpaid debts or tax liens. Furthermore, understanding the mortgage terms and payment history can give you an idea of the property’s overall value and investment potential.

In summary, mortgage records help you make informed decisions by offering transparency about a property’s legal and financial situation, which is critical for both residential and commercial real estate ventures.

7. Exploring Cuyahoga County’s Extensive Database: Cities and Villages Covered in Mortgage Records Search

Cuyahoga County’s mortgage records are accessible for properties across all its cities and villages, offering a comprehensive tool for anyone looking to search for mortgage information in this region. The county encompasses a variety of cities, towns, and villages, each with its own property records that are available for public access. This means that whether you’re looking for a property in Cleveland, Parma, Euclid, Lakewood, or any of the other municipalities within Cuyahoga County, you can easily obtain detailed mortgage records specific to each area.

Each city and village within the county has its own set of mortgage records that are linked to the county’s central database, ensuring that users can conduct targeted searches based on the specific area of interest. This wide coverage is invaluable for anyone involved in property research, as it guarantees that no property, regardless of its location in the county, is left out of the search process.

By offering access to mortgage records across the entire county, Cuyahoga County ensures that residents, buyers, sellers, and investors can gather information on properties in any community, allowing for better decision-making and a clearer understanding of the property market across the county.

8. Why Cuyahoga County Mortgage Records Matter for Homebuyers and Real Estate Investors

Cuyahoga County mortgage records are not only useful for verifying the ownership history of properties but also essential for making well-informed purchasing and investment decisions. For homebuyers, mortgage records offer crucial insights into the financial history of a property. Buyers can use this information to determine if the property is free of any unpaid liens or tax obligations that could affect their ability to purchase it.

For real estate investors, these records serve as a tool for identifying properties that are potentially undervalued or have hidden financial issues. By reviewing mortgage records, investors can gauge the risk level of a property, determine if it has been foreclosed on, or identify whether there are any financial disputes tied to the property. Additionally, mortgage records help investors track trends in property values and market dynamics, enabling them to make better strategic investment choices.

For both buyers and investors, mortgage records provide transparency, reduce the risks associated with property transactions, and support more confident decision-making in the real estate market.

9. Verifying Mortgage Information: How to Cross-Check Cuyahoga County Records with Official Sources

Verifying mortgage information is a critical step in the process of property research, and in Cuyahoga County, there are several ways to ensure that the data you find is accurate and up-to-date. The county’s Fiscal Office provides an official online tool for accessing mortgage records, but it’s important to cross-check the information with other reliable sources to verify its authenticity.

First, it’s important to confirm that the mortgage record you find corresponds to the specific property you are interested in. Cross-referencing the property’s parcel number or legal description in the county’s database with official documents such as the deed of sale or tax assessment records is a key step in ensuring the accuracy of the mortgage details.

Additionally, Cuyahoga County offers opportunities to verify mortgage records directly with their office. You can contact the Cuyahoga County Fiscal Office for additional information or to request certified copies of mortgage documents for legal purposes. This verification process adds an extra layer of confidence when making real estate decisions, ensuring that you are working with accurate and legally binding information.

For those seeking even further confirmation, engaging with title companies or real estate attorneys can provide another level of validation, particularly in more complex property transactions where legal disputes or issues are more likely to arise.

10. How to Interpret the Data in Cuyahoga County Mortgage Records: A Guide for Property Researchers

Interpreting the data in Cuyahoga County mortgage records is essential for making informed decisions regarding property investments, purchases, and legal matters. These records contain detailed information that is crucial for understanding the financial standing and legal obligations associated with a property. Key elements include the mortgage amount, interest rates, the lender’s name, and the date the mortgage was issued.

For property researchers, it’s important to understand how to interpret these data points to gauge a property’s financial history. The mortgage amount tells you how much the borrower owes, while the interest rate can provide insight into the financial terms of the loan. Additionally, the lender’s information can indicate whether the property is tied to a large financial institution or a private lender, which may have implications for future mortgage renewal or foreclosure risks.

Understanding these details can help property buyers and investors assess whether a property is a sound financial investment. By comparing the mortgage details with the property’s market value, researchers can determine whether the property is priced appropriately or if there are any potential risks tied to its financial history.

11. Exploring the Role of Cuyahoga County Mortgage Records in Property Tax Assessments

Mortgage records in Cuyahoga County play a significant role in property tax assessments, as they are used to verify ownership details and determine tax liabilities. Property tax assessments are based on the value of the property, and mortgage records often provide the necessary documentation to confirm ownership, allowing the county to properly assess and bill property taxes.

When a property changes ownership, the mortgage record is updated, which is an essential step in ensuring that the property’s tax records reflect the correct owner. These records can also be used to verify if there are any outstanding tax obligations or liens against the property, which can affect the amount of taxes owed.

For homeowners and real estate investors, it’s important to regularly check mortgage records to ensure that their tax assessments are accurate. If there are discrepancies between the mortgage record and the property tax assessment, it’s important to address these issues promptly to avoid overpaying or dealing with legal complications down the road.

12. How Cuyahoga County Mortgage Records Aid in Title Searches and Property Transfers

Cuyahoga County mortgage records are vital in the title search process and for property transfers. A title search is conducted to verify that a property has a clear title—meaning there are no liens, unpaid mortgages, or disputes over ownership. Mortgage records are crucial in this process because they provide insight into whether the property is encumbered by a mortgage or other financial claims.

When transferring property ownership, ensuring that the mortgage records are up to date is essential. A clean mortgage record indicates that there are no outstanding debts associated with the property, which is necessary for a smooth property transfer. If a property has an outstanding mortgage, the debt must be settled before the title can be transferred to the new owner.

For anyone involved in property sales, purchases, or title searches, reviewing the mortgage records ensures that the transfer is conducted legally and smoothly. Title companies often rely on mortgage records to verify that a property has a clear title and to identify any issues that may need to be resolved before a sale or transfer can take place.

Final Thoughts:

When it comes to navigating the property landscape in Cuyahoga County, mortgage records are a vital resource that can help you make smarter, more informed decisions. Whether you’re a first-time homebuyer, an investor looking for your next opportunity, or simply someone researching property details, these records provide essential insights into a property’s financial health, ownership history, and any outstanding liabilities.

By reviewing mortgage records, you can easily uncover crucial details like the mortgage amount, lender information, and any possible liens or debts tied to the property. This transparency helps you avoid unexpected surprises and ensures you’re fully aware of what you’re dealing with before moving forward with a purchase or investment.

It’s important to take your time when interpreting these records. They’re not just numbers—they represent a property’s entire financial journey, and understanding them can help you spot potential risks, verify ownership, or confirm whether tax assessments are accurate. Whether you’re assessing a property for investment or verifying its status for a potential sale, mortgage records provide clarity, giving you peace of mind as you make decisions that impact your future.

As you explore Cuyahoga County’s mortgage records, remember that double-checking the information you find with official sources adds an extra layer of confidence to your process. With the right tools and knowledge at your fingertips, you’re equipped to move forward with certainty in your real estate endeavors.

1. What Are Cuyahoga County Mortgage Records?

Cuyahoga County mortgage records are public documents that track the financial details of properties, including the amounts borrowed, the lender, and the terms of the loan. These records are essential for verifying property ownership, checking liens, and assessing the financial history of properties. They are accessible to the public through the county’s official database and serve as an important resource for homebuyers, investors, and researchers.

2. How Can I Access Cuyahoga County Mortgage Records?

To access mortgage records in Cuyahoga County, you can visit the Cuyahoga County Fiscal Office website. The online database allows you to search for mortgage records by entering the property’s address, owner’s name, or parcel number. You can also visit the office in person if you need certified copies of specific records for legal purposes.

3. Why Are Mortgage Records Important for Real Estate Investors?

For real estate investors, mortgage records are essential for assessing the financial history of a property. They can reveal crucial information such as outstanding debts, lien details, and mortgage amounts. Investors can use this data to evaluate the investment potential of a property, avoid risky purchases, and identify opportunities for acquiring undervalued properties with clear financial records.

4. How Do Cuyahoga County Mortgage Records Help in Title Searches?

Cuyahoga County mortgage records play a key role in title searches by confirming the current ownership of a property and identifying any existing financial claims, such as mortgages or liens. A clean mortgage record ensures that the title is clear, which is essential for a successful property transfer. Mortgage records are used by title companies to ensure there are no legal disputes or encumbrances on the property.

5. Can Mortgage Records Show Property Tax Liabilities?

Yes, mortgage records in Cuyahoga County can indirectly help identify property tax liabilities. When a property has a mortgage, tax records may also be associated with it. Lenders often include property tax payments as part of the mortgage escrow, and mortgage records may show any unpaid property taxes, liens, or delinquent payments, providing valuable insights into the property’s financial obligations.

6. How Are Mortgage Records Used in Property Transfers?

Mortgage records are essential in property transfers as they confirm whether a property is subject to an existing mortgage or financial claims. If a mortgage is still active, the seller must pay off the mortgage before transferring the property to the buyer. The mortgage record provides clarity on the remaining balance and any liens tied to the property, ensuring a smooth and legal transfer.

7. What Information Is Included in a Cuyahoga County Mortgage Record?

A Cuyahoga County mortgage record typically includes the mortgage amount, interest rate, lender’s name, and loan date. It also lists the property address, borrower’s name, and any liens or claims against the property. This information helps property buyers and investors assess the financial standing of a property, including any unpaid debts that might affect the property’s value.

8. How Often Are Cuyahoga County Mortgage Records Updated?

Cuyahoga County mortgage records are updated regularly as new mortgages are filed or existing ones are paid off. Changes in mortgage status, including refinancing or foreclosure, are also updated in real-time to maintain accuracy. The county’s online database reflects these changes, so you can access the most current mortgage details whenever you need them.

9. Are Mortgage Records Public in Cuyahoga County?

Yes, mortgage records in Cuyahoga County are public documents and can be accessed by anyone. These records provide transparency and help verify ownership and financial details about properties. Public access ensures that individuals, real estate professionals, and investors can make informed decisions when purchasing, selling, or researching properties.

10. Can I Search Mortgage Records by Owner’s Name?

Yes, you can search mortgage records in Cuyahoga County by entering the property owner’s name in the online search tool. This option allows you to find all mortgages associated with a particular individual, helping to track ownership changes or identify properties tied to specific individuals or entities. This feature is useful for anyone conducting thorough property research.

11. What Is the Difference Between Mortgage Records and Deed Records?

Mortgage records and deed records serve different purposes. Mortgage records detail the financial aspects of a property, including the loan amount, lender information, and payment terms. Deed records, on the other hand, confirm the legal transfer of property ownership. While mortgage records track the debt tied to the property, deed records show who legally owns the property.

12. How Do Cuyahoga County Mortgage Records Impact Property Tax Assessments?

Mortgage records are indirectly related to property tax assessments in Cuyahoga County. The county uses mortgage information to confirm ownership and financial details, ensuring that the property tax bills are correctly assigned to the right individual. Additionally, reviewing mortgage records can help identify any outstanding property tax obligations or liens tied to the property.

13. What Happens If a Mortgage Is Not Paid in Cuyahoga County?

If a mortgage is not paid in Cuyahoga County, the lender may initiate foreclosure proceedings. This process allows the lender to take possession of the property and sell it to recover the unpaid loan balance. Mortgage records will show if a property is in default or has been foreclosed on, helping potential buyers or investors avoid properties with legal or financial issues.

14. How Can I Use Cuyahoga County Mortgage Records to Verify a Property’s Financial Status?

You can use Cuyahoga County mortgage records to verify a property’s financial status by checking for outstanding mortgage balances, lender details, and any liens or encumbrances. These records give you a snapshot of the property’s debt obligations and help you assess whether the property is financially stable or encumbered by legal claims that may impact its value.

15. Are There Fees for Accessing Mortgage Records in Cuyahoga County?

Accessing mortgage records online in Cuyahoga County is generally free for basic searches. However, there may be fees for obtaining certified copies of mortgage documents or for in-depth record searches. These fees help maintain the county’s database and cover the cost of processing requests for certified copies or more detailed documentation.

Pingback: Cuyahoga County Record Search Administration

Pingback: Complete LLC Tax Rates for All Cities in Cuyahoga County, Ohio and Tax Calculator